does nevada have an inheritance tax

Additionally many states allow the levying of local sales taxes which are. Inheritance tax and estate tax refer to the taxes you must pay on property you receive from someone who is deceased.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Theres No Corporate Income Tax.

. However many states do. There are two types of taxes possible on an inheritance but they are rare. No Estate Tax Laws in Nevada To beneficiaries of an estate learning that inherited property is located in Nevada can feel like watching all three wheels of a slot machine.

Almost all states employ a statewide sales tax which ranges from 29 percent in Colorado to 725 percent in California. Zero No Nevada State Income Tax. Fortunately for Nevada residents Nevada does not assess a gift tax.

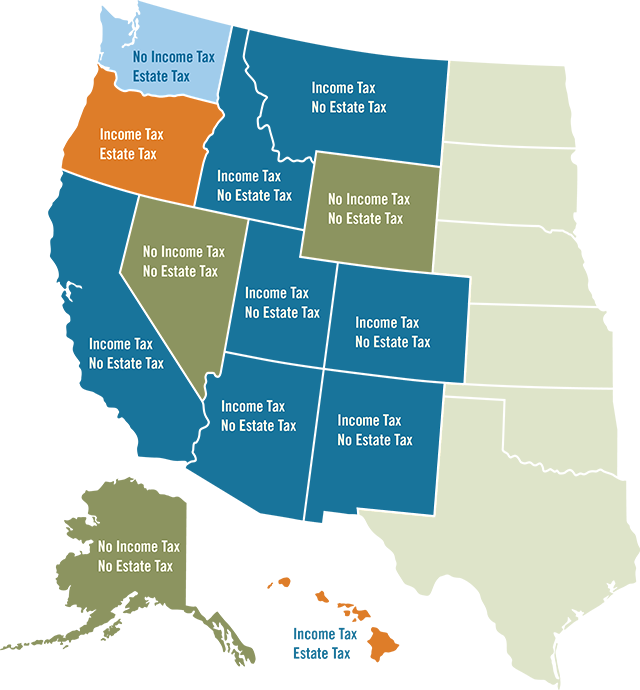

Nevada Inheritance Tax and Estate Tax. There is no federal inheritance tax and only six states levy the. For instance in Kentucky inheritance tax is paid where you inherit a property situated there.

The state of Nevada does not collect taxes on inheritances. To be subject to. Does Nevada Have an Inheritance or Estate Tax.

However estates valued above 1206 million in 2022 are subject to a federal. There is no federal inheritance tax but there is a federal estate tax. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets.

No Nevada does not apply an inheritance or estate tax. Theres No Franchise Tax. The federal estate tax generally applies to assets over 1206 million in 2022 and 1292 million in 2023.

State gift tax assessments are rare. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax. Do I Have to Pay Taxes on an Inheritance in Nevada.

Impose an estate tax and very few in fact. Just twelve states in the US. Nevada generally is a tax-friendly state there are some.

No Nevada Inheritance Tax after 3 years of residency. Inheritance tax is collected when a beneficiary inherits money property or other assets after someone dies.

State Estate And Inheritance Taxes In 2014 Tax Foundation

Nevada State Line A Debt Free State Welcomes You Debt Free Nevada State Free State

What Do I Do After My Loved One Dies How To Probate An Estate In Nevada Kindle Edition By Kaplan Kirk Professional Technical Kindle Ebooks Amazon Com

How Do State Estate And Inheritance Taxes Work Tax Policy Center

State Estate And Inheritance Taxes Itep

State Estate And Inheritance Taxes Itep

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Las Vegas Estate And Gift Tax Figures Las Vegas Estate Planning Attorneys

Nevada Vs California Taxes Explained Retirebetternow Com

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Greetings From Nevada The One Sound State Nevada Nevada Usa Greetings

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Nevada Income Tax Nv State Tax Calculator Community Tax

How Many People Pay The Estate Tax Tax Policy Center

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)