income tax rates 2022 vs 2021

19 cents for each 1 over 18200. The capital gains annual exempt.

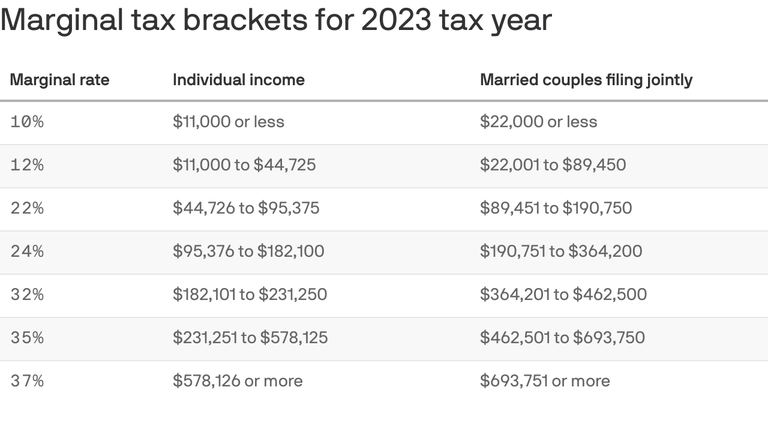

Here Are The Federal Income Tax Brackets For 2023

Web 2021-2022 tax brackets and federal income tax rates.

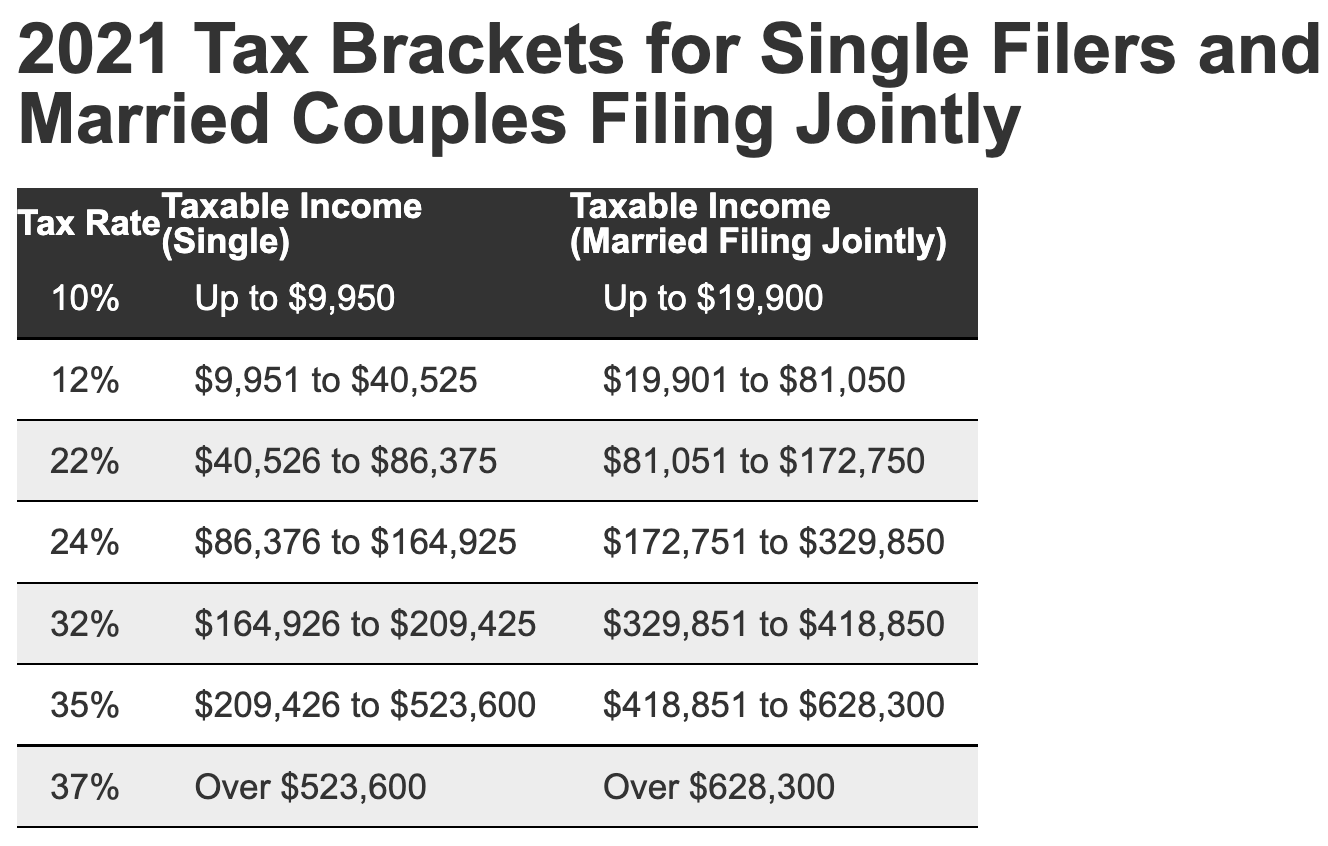

. Below are the official 2021 IRS tax brackets. Web Resident tax rates 202223. Web The 2022 and 2021 tax bracket ranges also differ depending on your filing status.

10 12 22 24 32 35 and 37. Web These tax rate schedules are provided to help you estimate your 2022 federal income tax. 0 percent for income up to 41675.

Weve got all the 2021 and 2022. Your bracket depends on your taxable income and filing status. Web 2021 Tax Brackets.

Web The dividend allowance is to be reduced from the current 2000 to 1000 from April 2023 and then to 500 from April 2024. For example for single filers the 22 tax bracket for the 2022 tax year starts at. Tax on this income.

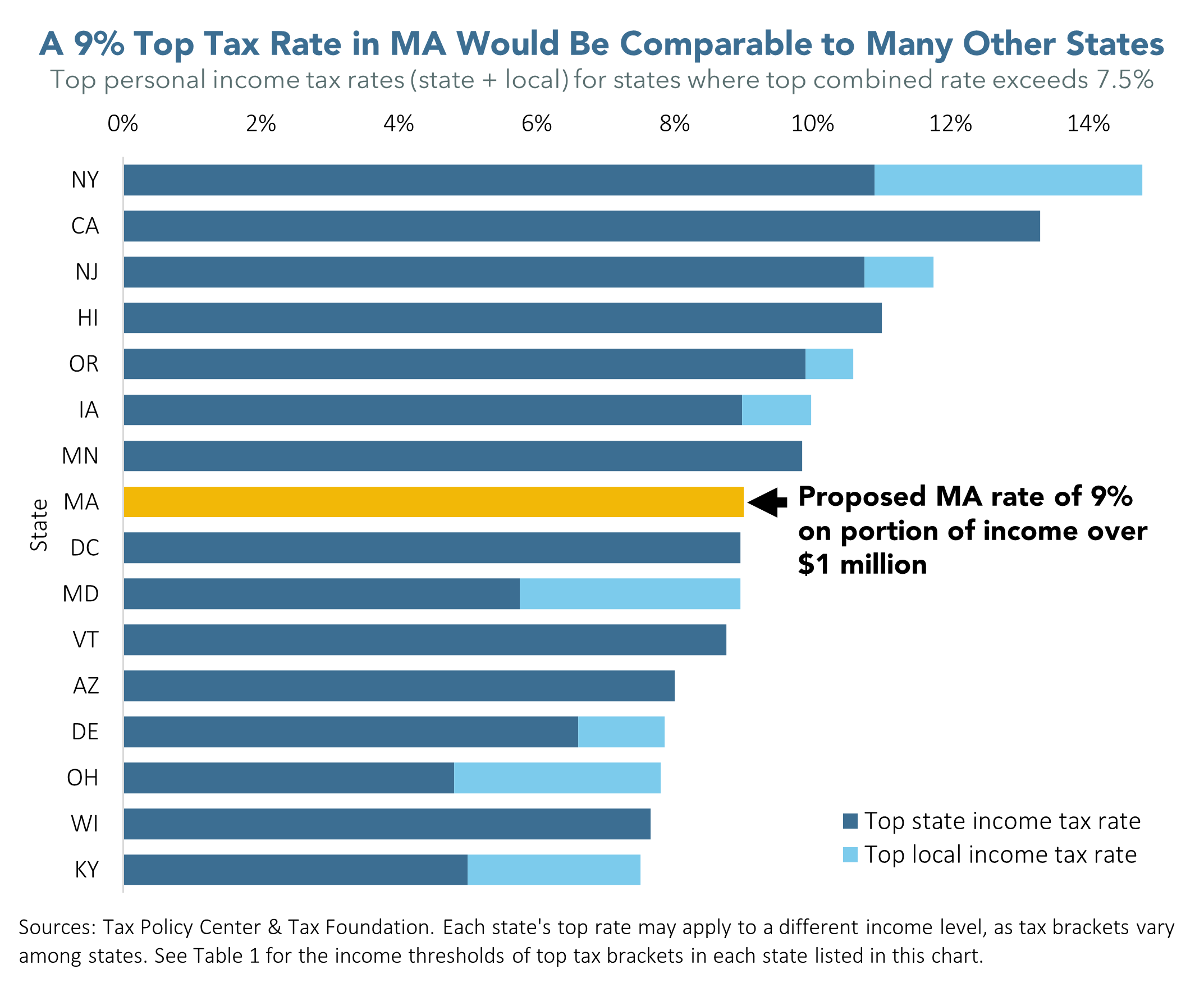

Web Any taxable income exceeding 25 million is subject to the top marginal rate of 109 percent. This guide is also available in Welsh Cymraeg. Web In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

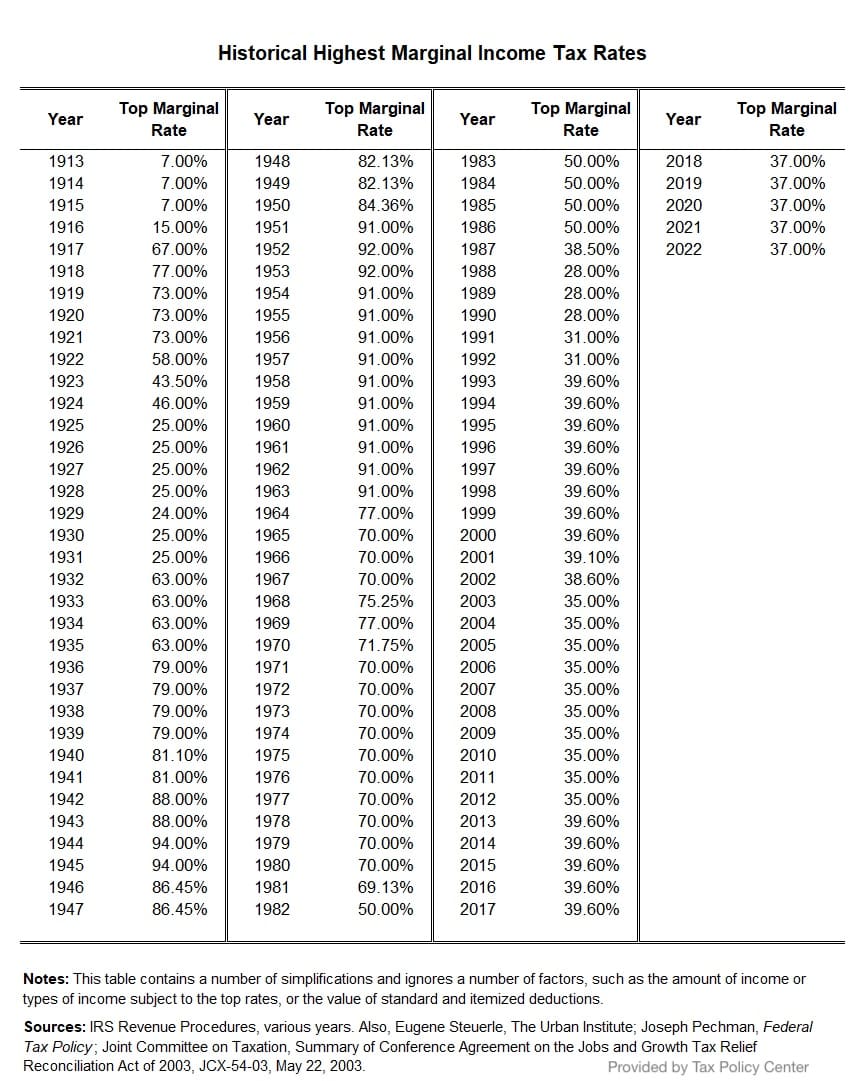

There are seven federal income tax rates in. Web Income Tax Rates of Partnership Firm LLP for FY 2021-22 FY 2022-23. Web Tax brackets for income earned in 2022.

However some of your income will be taxed at the lower tax. Web There are seven federal tax brackets for tax year 2022 the same as for 2021. Web For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and ends at 89075.

As noted above the top tax bracket remains at 37. However for head-of-household filers it goes. Web Thats up 900 from 2022s 12950 standard deduction.

Tax on this income. Taxable income Tax rate. 2021 Income Tax Brackets.

The amount of income. Web Resident tax rates 202223. You may be preparing to file your 2021 income taxes but in just a few weeks.

For example for single filers the 22 tax bracket for the 2022 tax year starts at. Web Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. For married couples filing jointly for tax year 2023 the standard deduction climbs to 27700.

Web There are seven federal tax brackets for the 2022 tax year. Web If you are single and your taxable income is 75000 in 2022 your marginal tax bracket is 22. The other six tax brackets.

TurboTax will apply these rates as you complete your tax return. Those earning between 13900 and 215400 are subject to marginal. Web The capital gains tax rates will remain the same in 2022 but the brackets will change.

Web The 2022 and 2021 tax bracket ranges also differ depending on your filing status. Web Welcome to the topic 2022 IRS Income Tax Brackets Vs. 10 percent 12 percent 22.

There are seven tax brackets for most ordinary income for the 2021 tax year. 15 percent for income between 41675. Partnership firm including LLP is taxable at 30.

Web The current tax year is from 6 April 2022 to 5 April 2023. 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950. Note that the updated tax rates and taxable income brackets would only apply for the 2021 tax.

19 cents for each 1 over 18200.

What Are The Income Tax Brackets For 2022 Vs 2021

2022 Income Tax Brackets And The New Ideal Income

State Individual Income Tax Rates And Brackets Tax Foundation

Effective Tax Rates And Stock Based Compensation The Footnotes Analyst

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

How Does The Corporate Income Tax Work Tax Policy Center

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate

New 2022 Foreigner Income Tax Changes To Expense Deductions Fdi China

2022 2023 Federal Income Tax Brackets Tax Rates Nerdwallet

Marginal And Average Tax Rates 1070 Income Tax Preparation Law 2021 2022 Youtube

With Millionaire Tax Massachusetts Top Tax Rate Would Compare Well To Top Rates In Other States Mass Budget And Policy Center

Tax Rates Congressional Budget Office

How The Tcja Tax Law Affects Your Personal Finances

2022 Income Tax Brackets And The New Ideal Income

How Tax Brackets Work 2023 Tax Brackets White Coat Investor

2021 2022 Federal Income Tax Brackets And Rates

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp